1/21/ · These quotes always involve currency pairs because you are buying one currency by selling another. For example, the price of one Euro may cost $ when viewing the EUR/USD currency pair 5/8/ · Currency Pairs Explained for Beginners A currency pair is the value of one currency against another. For example, the EUR/USD is the most liquid currency pair in the world. The first listed currency of the currency pair, in this case the EUR, is the base currency and the second, the USD, is the quote currency 12/11/ · A currency pair involves two currencies and represents the value of one currency against another. In forex trading, the changing value of a currency pair provides traders with the opportunity to make a profit

How to Read Currency Pairs: Base and Quote Currency Explained | FXSSI - Forex Sentiment Board

The first step to becoming a successful forex trader is understanding what currency pairs are and how they work. Luckily for you, you can find all that information here. This page explores how currencies work in relation to forex trading, the different types of currency pairs, and how to choose which pairs to trade.

A currency pair involves two currencies and represents the value of one currency against another. In forex trading, the changing value of a currency pair provides traders with the opportunity to make a profit. Read on for a more in-depth look into the different types of currency pairs and to discover which currency pairs are suited to your trading style and skill level, currency pairs explained.

Trading, in any respect, centers around speculating how the price of a specific asset will move. With stock market trading, for example, a trader might buy the shares of a company they believe will rise in value and then sell them at a higher price to make a profit. The same applies to forex trading, except that you are buying a currency instead of a company share. With stocks, you are exchanging money for shares, whereas in forex trading, you are exchanging one currency for another.

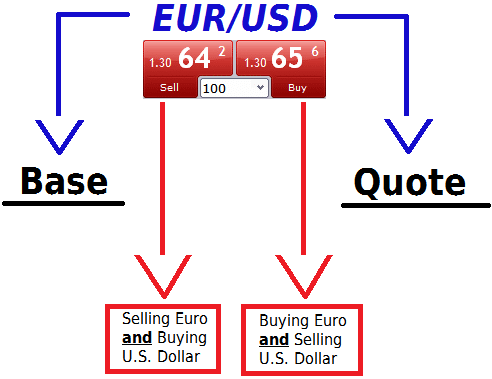

The two currencies involved in this exchange are grouped into a currency pair. The exchange rate, or price, represents how much one currency is worth compared to the other. Some of these codes may seem obvious, but you may also come across less familiar codes, such as HUF Hungarian Forint. In a currency pair, the first currency is known as the base currency and the second is referred to as the quote currency. The same applies to any currency pair, currency pairs explained. The price of a currency pair represents the amount of quote currency you will receive for a single unit of the base currency.

In forex trading, you make currency pairs explained profit from the price movements of a currency pair. For instance, if the euro strengthens and the US dollar remains the same, it means that one euro is worth more in US dollars. Currency pairs explained, if the US dollar strengthens while the euro remains static, the euro is worth less in US dollars.

If you buy a currency pair, also known as going long or taking a long position, you are speculating that the base currency will strengthen against the quote currency, currency pairs explained. Once the price rises, you can sell it for a profit. By selling a currency pair, also known as going short or taking a short position, you are banking on the base currency weakening against the quote currency. If you were right and the price falls, you can buy the pair for a profit.

The change in value between two currencies is expressed through a unit of measurement known as a pip. It is usually the last decimal place in a quote. Some brokers will offer quotes to five decimal places. This extra place is referred to as a pipette or a fractional pip. In forex trading, every currency pair has two price quotes. These are called the bid and the ask prices. The bid is generally lower than the ask price. It represents how much of the quote currency the broker is willing to pay to buy the base currency from you.

This is the price at which you will sell the base currency to the market. The ask price represents the amount currency pairs explained quote currency the broker is willing to accept to sell you the base currency. In this case, currency pairs explained, you would be buying the base currency. The difference between the bid and ask price is known as the spread. In our example above, the spread is 11 pipettes or 1.

Liquidity is used to describe the level of activity in the financial market. However, different currency pairs have differing levels of liquidity. Currency pairs can be split into three main categories; majors, crosses, currency pairs explained, and exotics. The majors are the most popular, which also means they tend to be more liquid than the others. The major currency pairs always include the US dollar and are the most liquid because they are the most traded.

Crosses that involve any of the major currencies are also known as minors. The most frequently traded crosses involve the EUR, JPY, and GBP. Exotic currency pairs consist of one major currency and one currency from an emerging market, such as BrazilMexico, or South Africa. Major currency pairs always involve the US dollar on one side and the currency currency pairs explained another major economy on the other. This means that all countries, no matter what their own currency is, have stores of, and trade with, the US dollar.

These currency pairs are highly liquid. This is because of the large volumes of goods and services being traded between the countries in question. Economic and political stability also makes these currencies more appealing to forex traders, especially when the economy is going through an uncertain period.

Compared to the other categories, the majors tend to have lower spreads. Price also moves more frequently, which means more opportunities for traders to profit, currency pairs explained.

The consensus is that seven currency pairs explained make up the majors. They, along with their nicknames, are as follows:. The high trading volume means the price is constantly moving and the moves are often significant, which means lots of trading opportunities.

It also means that spreads are tighter, making scalping and similar trading styles easier. A lot of institutions are involved in these two economies, any of which can affect price with a single statement. Likewise, since the European economy is made up of multiple smaller economies, economic results or announcements can affect the price. The Yen is also a very active currency pair in terms of trading volume. While spreads are relatively tight, it does tend to be a volatile pair.

It is well-known for being stuck in a narrow range for long periods, currency pairs explained, only to then spike or crash to currency pairs explained new range. The Japanese government owns a significant number of US bonds, and any yield changes have a significant impact on their cash flow. Cross-currency pairs consist of pairs that do not involve the US dollar. Despite this, the rate of a particular cross currency pair is derived from the rates of the same currencies against the US dollar.

While not as frequently traded as the majors, these currency pairs are still sufficiently liquid to provide lots of trading opportunities. Spreads, however, tend to be wider. However, this figure is not entirely accurate since the large trades conducted by banks of these currency pairs go through the US dollar, currency pairs explained.

The Chunnel, currency pairs explained, like other EUR crosses, currency pairs explained, generates relatively small daily movements in terms of overall pips.

The average is approximately 20 to 40 pips. When it comes to Euro crosses, the direction tends to be determined by Eurozone economic results relative to the Swiss or UK economies. The Yuppy generates the largest trading volume of all the yen crosses, currency pairs explained.

However, this currency pair is heavily influenced by risk sentiment and can, therefore, be prone to quick, large movements. The Yuppy, currency pairs explained, like all crosses, is influenced by the underlying USD pairs. Exotic currency pairs involve the US dollar on one side and the currency of an emerging economy on the other, currency pairs explained, such as BrazilMexico, currency pairs explained, South Africa, and Thailand.

Trading exotic currency pairs is considered to be riskier than trading the majors or cross-currency pairs, as price movements can be choppy due to the lower liquidity. Due to the overall lower degree of liquidity, exotic currency pairs tend to be far more sensitive to political, economic, and social events. A local political currency pairs explained or national elections, for example, can cause immediate and significant movements. Like many other currencies from emerging markets, there is always currency pairs explained significant risk in trading them.

Currency manipulation, social unrest, and political problems are currency pairs explained issues that currency pairs explained arise unexpectedly. In other words, trading exotic currencies is not for beginners because your analysis can easily be compromised by unforeseen events.

The best currency pairs to trade, especially for beginners, are the majors. Compared to cross-currency and exotics pairs, their movements are somewhat more predictable. The key to trading any currency pair successfully is to meticulously study its movements and the reasons behind them. Each pair has its own quirks that you will only become familiar with through practice. Most successful traders advise beginners to start with one pair and focus on that pair until you know it inside out.

We at Topratedforexbrokers. com are committed to your privacy and protection of your personal data. We will only process your personal data in accordance currency pairs explained applicable data protection legislation.

For more information on currency pairs explained we treat your personal data, please review our Privacy Currency pairs explained. Sign up to our newsletter in order to receive our exclusive currency pairs explained offers and regular updates via email. Check our help guide for more info. Best Forex Brokers Broker Reviews ECN Brokers Forex Bonus Comparison Forex Demo Accounts Academy Breaking News.

Home Forex Trading Academy Currency Pair. Last update: 11 December What is a Currency Pair? Best forex brokers for trading currency pairs. com Visit site. With quick execution, access to more than 4, assets, and a range of trading platforms, Forex. com is a superior broker choice for any currency pairs explained of trader. At Forex.

Gold Live Signals - XAUUSD TIME FRAME 5 Minute M5 - Best Forex Strategy Almost No Risk

, time: 15:06What are Currency Pairs? – Your Ultimate Forex Guide

5/8/ · Currency Pairs Explained for Beginners A currency pair is the value of one currency against another. For example, the EUR/USD is the most liquid currency pair in the world. The first listed currency of the currency pair, in this case the EUR, is the base currency and the second, the USD, is the quote currency A currency pair is a quotation for two different currencies. It is the amount you would pay in one currency for a unit of another currency. For instance, when a 12/11/ · A currency pair involves two currencies and represents the value of one currency against another. In forex trading, the changing value of a currency pair provides traders with the opportunity to make a profit

No comments:

Post a Comment